- FEATURE

- |

- MERGERS & ACQUISITIONS

- |

- FINANCIAL

- |

- MARKETING

- |

- RETAIL

- |

- ESG-SUSTAINABILITY

- |

- LIFESTYLE

- |

-

MORE

In 2024, international beauty brands that frequently emphasized "consumer education" found themselves outpaced by Chinese consumers, who no longer fall for traditional brand narratives.

Years of exposure to global campaigns, exclusive product launches, and cutting-edge innovations have made Chinese consumers some of the most sophisticated in the world. Adding to this are local beauty brands, which share their innovative technologies openly, and the rise of knowledgeable beauty influencers. As a result, many Chinese consumers have become well-versed in industry jargon, some even resembling beauty experts themselves. These savvy shoppers—including older generations—are no longer impressed by labels like "luxury" or "niche."

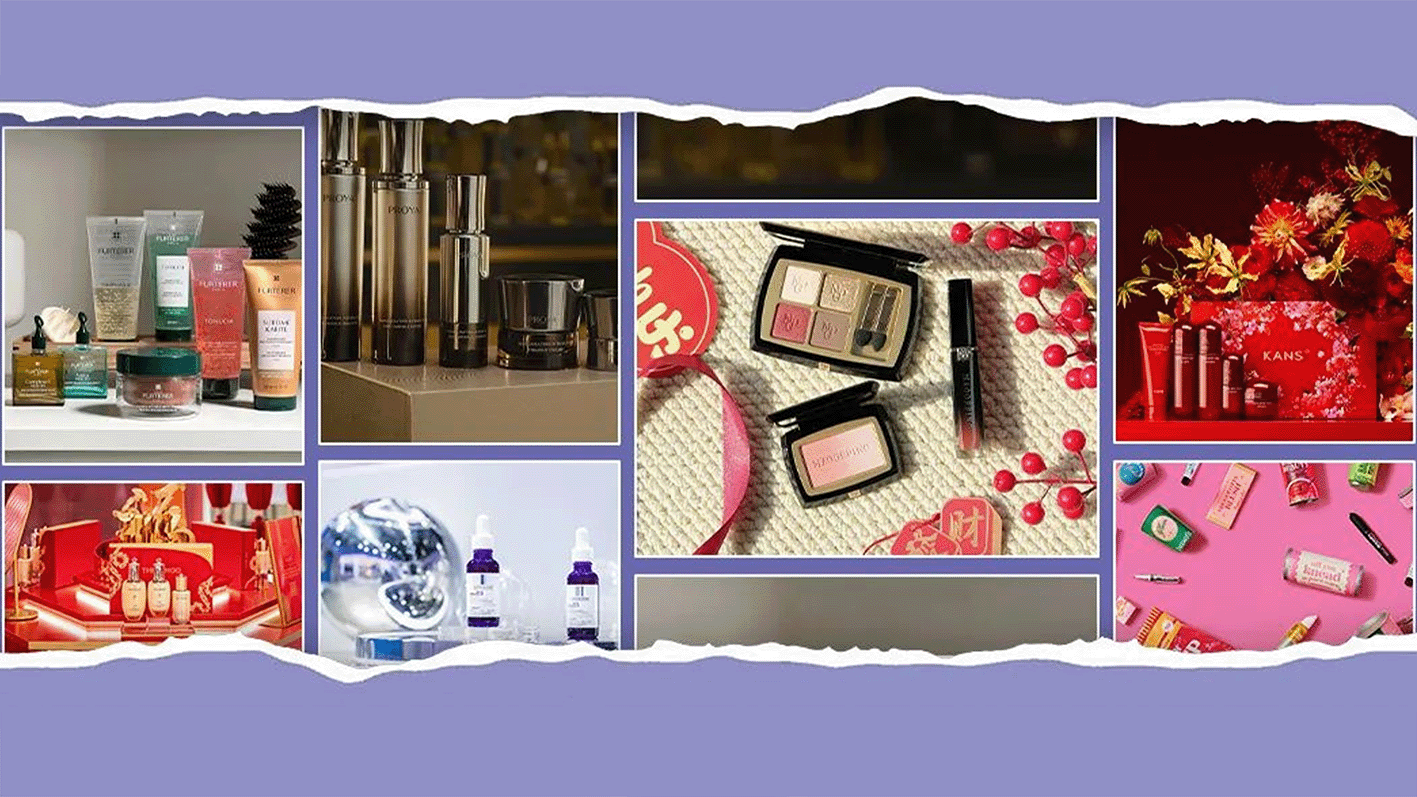

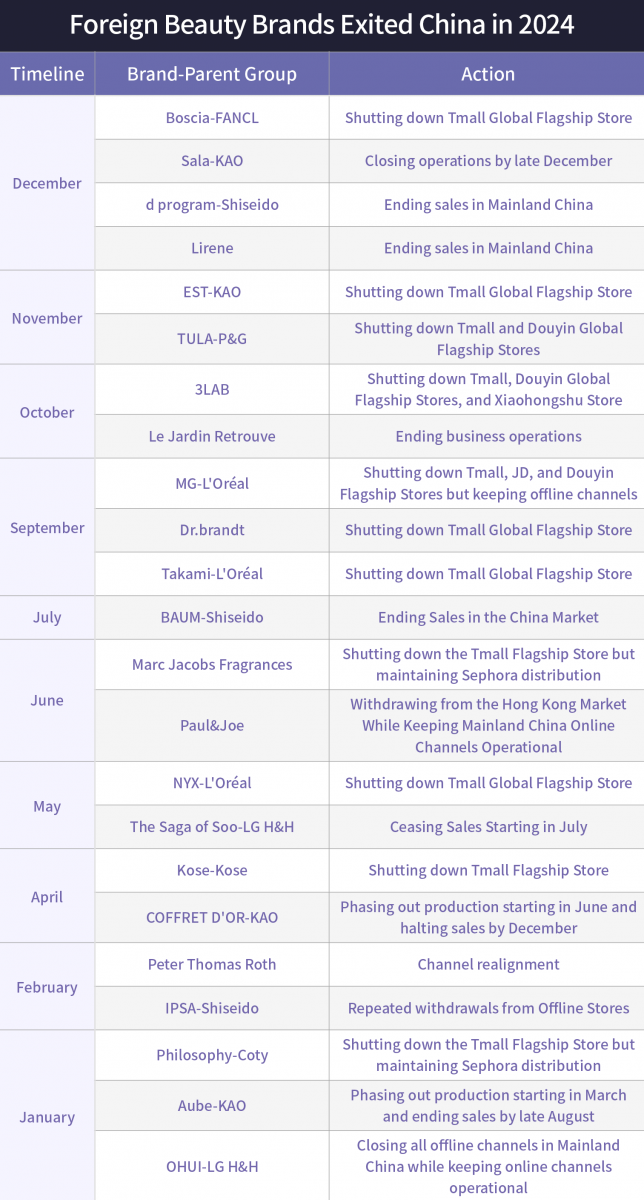

This shift has rendered the old playbook for international beauty brands ineffective. The financial repercussions were stark in 2024, with many global beauty giants reporting disappointing earnings and a steady "mass exodus" of brands—on average, at least two international names exited the Chinese market each month.

While some companies described these exits as "channel adjustments," the reality is clear: without bold changes in product offerings, marketing strategies, and mindset, the trend will continue into 2025. For brands, this means losing a critical customer base. For consumers, it means missing out on potential "hidden gems." To avoid this lose-lose scenario, ConCall has identified actionable strategies for international beauty brands to thrive in China’s competitive market.

While international brands excel at "storytelling," today’s sharp and informed Chinese consumers expect more. To stay competitive and relevant, brands must anchor themselves with standout hero products while regularly introducing innovative and exciting new launches to keep consumers engaged.

La Roche-Posay offers a great example. The brand first captured the attention of Chinese consumers with its Thermal Spring Water and then built a loyal following with products like Anthelios sunscreen, B5 Cream, and B5 Masks. These staples helped the brand grow its reputation, fueled by positive word-of-mouth that solidified its credibility and influence.

More recently, La Roche-Posay has sustained this momentum by continuously innovating and expanding its product lineup in China. Leveraging the strong R&D capabilities of its parent company, L’Oréal Group, the brand launched the Effaclar Serum targeting acne-prone skin, introduced its Regenmedic series, and debuted several new products at the 2023 CIIE, such as the B5 Multi-Repair Serum, DUO+M Lotion, and the Mela B3 Serum featuring the innovative ingredient Melasyl.

In contrast, brands like Benefit Cosmetics and Peter Thomas Roth highlight the risks of complacency.<