- FEATURE

- |

- MERGERS & ACQUISITIONS

- |

- FINANCIAL

- |

- MARKETING

- |

- RETAIL

- |

- ESG-SUSTAINABILITY

- |

- LIFESTYLE

- |

-

MORE

On Wednesday, September 13th, De Beers, a British company both a jewelry brand and diamond supplier, announced the discontinuation of its engagement ring product line under its "game-changer" subsidiary, Lightbox. Engagement rings (both engagement and wedding rings) have consistently been a key market segment for all diamond brands, high-end jewelry houses, and jewelers, and Lightbox has been the most important subsidiary incubation project of De Beers in the past few years, indicating De Beers has gleaned lessons on how to navigate the rising trend of lab-grown diamonds in the past few years and is now reevaluating its current and future business strategy.

However, this news prompts observers to consider the commercial prospects of lab-grown diamonds.

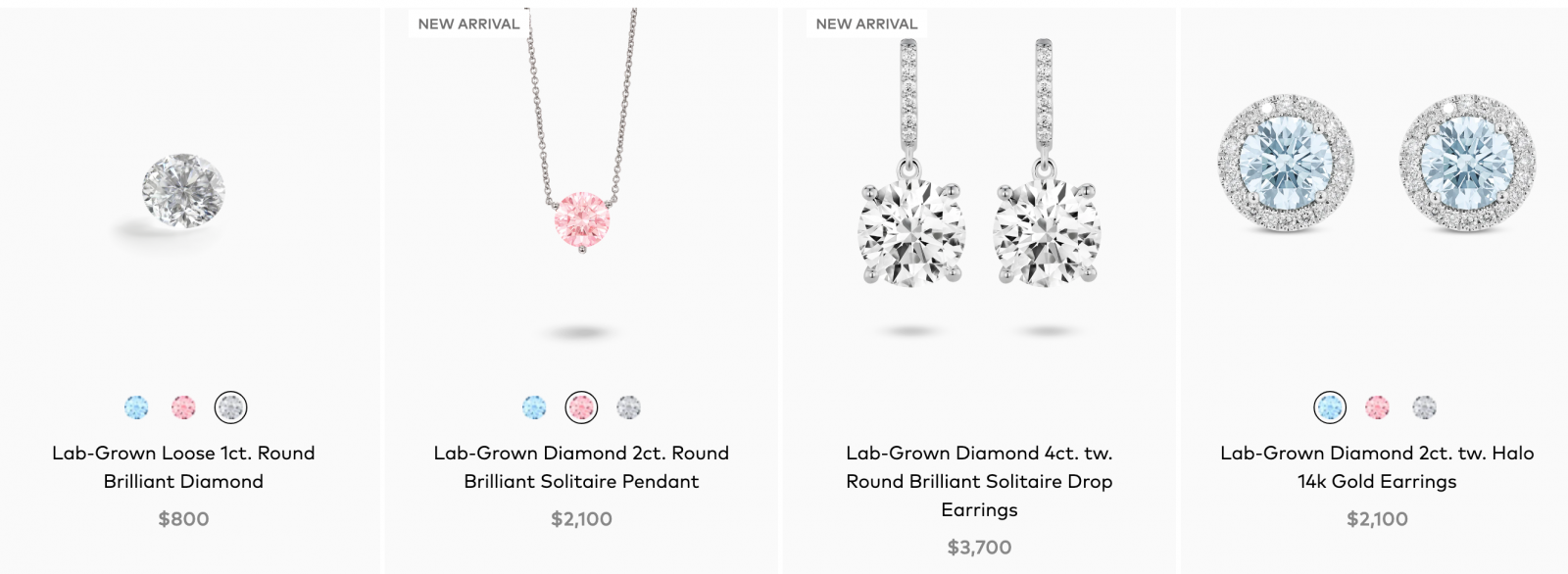

Established by De Beers in 2018, Lightbox's primary goal was to seize the initiative as the market started to pay attention to lab-grown diamonds, leading the category's development. It even set a strict pricing model for these lab-grown diamonds, regardless of their size or color, at a standard rate of $800 per carat. Obviously, this pricing strategy, which defied market economic consensus, was ambitious but fraught with hidden risks.

One significant threat came from one of the world's largest diamond consumers—China. Global market data reveals that China's capacity for producing lab-grown diamonds for jewelry accounts for approximately 50% of the total global lab-grown diamond production capacity, with 80% of that output originating from Henan Province. In 2021 alone, lab-grown diamond production in Zhecheng County, Henan Province, came close to half of the global production, rapidly lowering the price per carat to around 5,000 Chinese yuan. Following China, the United States and India have also become important participants in the global lab-grown diamond supply chain.

Apparently, De Beers was unable to establish a dominant pricing position by launching Lightbox due to its inability to monopolize lab-grown diamond production and trade, thus failing to realize its ambition to shape the underlying logic of the lab-grown diamond industry. This fundamental instability implies that the diamond giant needs to make strategic adjustments promptly.

Even when a crisis lurks, Lightbox continues to make efforts. Just in June, Lightbox announced that its lab-grown gemstone production process had achieved carbon neutrality, with 100% of the energy consumed coming from renewable power, by the wind.

Lightbox also introduced a limited collection, featuring simple gold rings and halo-style settings with lab-grown tiny diamonds. The center diamonds ranged from one to two carats, with a maximum retail price of $5,000, averaging around $2,500. From a design and pricing perspective, this series appeared to be striving to achieve "sustainability" and "accessible" engagement rings. However, market feedback did not meet expectations.<