- FEATURE

- |

- MERGERS & ACQUISITIONS

- |

- FINANCIAL

- |

- MARKETING

- |

- RETAIL

- |

- ESG-SUSTAINABILITY

- |

- LIFESTYLE

- |

-

MORE

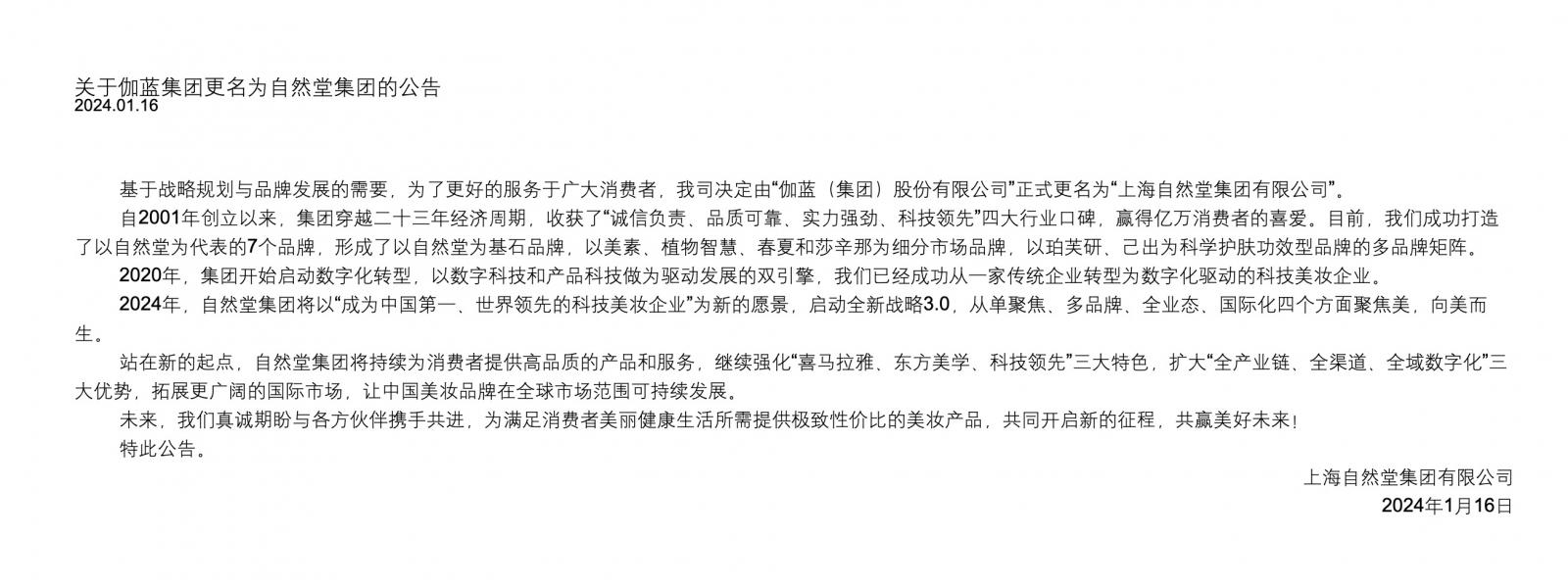

Last week marked a strategic shift for Jala Group as it unveiled its new identity: "Chando Group." The move aligns with its strategic and brand development goals, aiming to enhance consumer engagement.

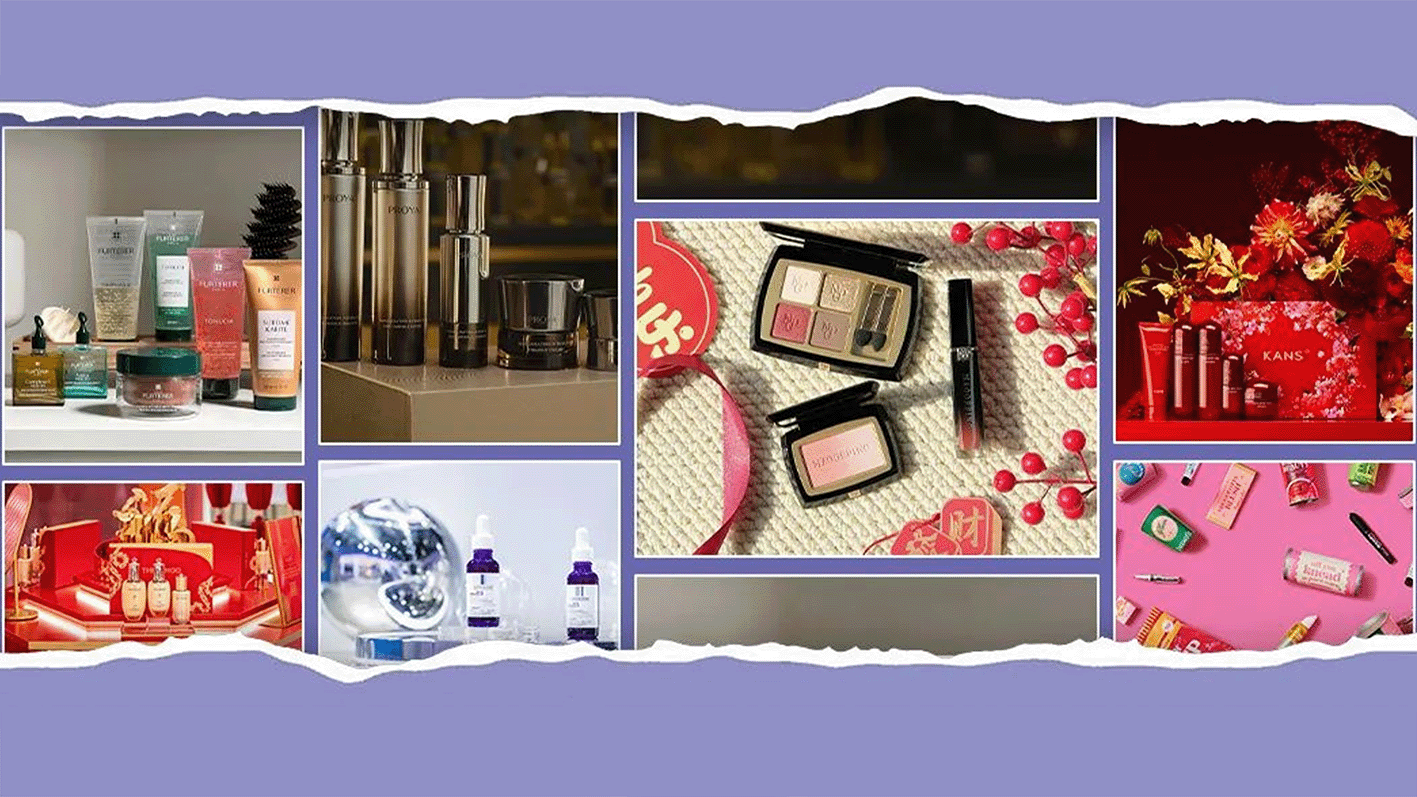

This rebranding adds to the trend of local beauty giants adopting their flagship brands' names, joining the likes of Proya and Marubi.

Since 2020, China's beauty sector has witnessed a dramatic surge and intense competition, with Jala Group being a pivotal player. This rebranding reflects a significant change, worthy of attention and discussion.

In Chinese culture, "Jala" resonates with beauty and positivity. The group shared earlier, "Jala," derived from Sanskrit, means "water," symbolizing a place of life, beauty, and abundance.

Established in 2001, the group has mirrored its name's essence, creating an empire with 7 brands including Chando, over 40,000 retail outlets, and an annual turnover exceeding 5 billion yuan. This has cemented its status as a key player in China's local beauty industry.

Chando, with its diverse consumer base, is the group's most developed brand. It dominated the 2019 "Double 11" sales, becoming the top national brand in both offline stores and brand total sales, with online sales reaching 747 million yuan, a 41% increase from the previous year. In 2020, CBNData showed Chando as the leader in online skincare consumption in China. Chando has indeed been a trendsetter in the nascent wave of national beauty products.<