- FEATURE

- |

- MERGERS & ACQUISITIONS

- |

- FINANCIAL

- |

- MARKETING

- |

- RETAIL

- |

- ESG-SUSTAINABILITY

- |

- LIFESTYLE

- |

-

MORE

With Watches & Wonders Geneva (WWG) 2025 — the global watch world’s most important event — only a month and a half away, Morgan Stanley and Swiss watch consultancy LuxeConsult have released the 2024 Swiss Watch Industry Annual Report. Among its standout findings is a list of the top 50 Swiss watch brands by estimated annual revenue.

Overall, the report — candid to the point of bluntness — delivered few surprises or shocks. But the shifts in the Top 50 ranking and the accompanying analysis make one thing clear: the watch industry is undergoing profound changes, which will have far-reaching repercussions for the market itself. In short, the industry is being reshaped.

In broad terms, the same pattern seen last year — jewelry managing to climb while watch sales kept stumbling — is reflected in this report. Meanwhile, the market’s polarization into winners and losers has grown even more pronounced.

After three years of rapid post-pandemic growth, the Swiss watch industry hit a contraction in 2024, according to the report. The combined revenue of the top 50 brands slipped about 3% to CHF 35.258 billion, and total unit sales fell by roughly 2.5 million compared to 2023. The primary culprit was a slowdown in the Chinese market.

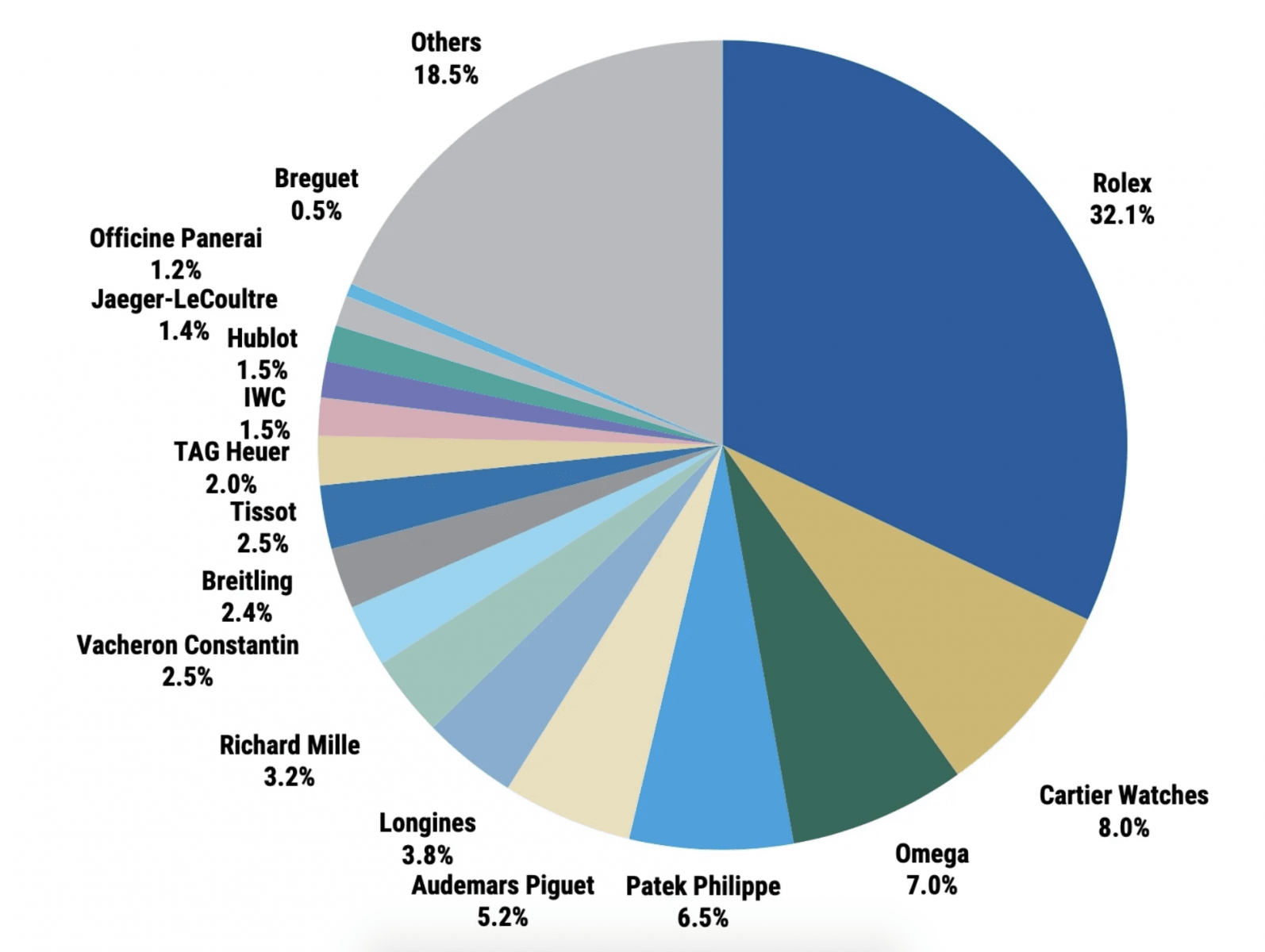

Still, even as the overall market slowed, eleven brands managed to grow their revenue last year — and the biggest players grabbed even more market share. The Top 6 brands remained exactly the same as in 2023: in order, Rolex, Cartier, Omega, Audemars Piguet, Patek Philippe, and Richard Mille.

Rolex continued to dominate with an unassailable lead. The brand sold 1.176 million watches in 2024, and its estimated revenue reached around CHF 10.58 billion — building on the CHF 10 billion milestone it had already surpassed in 2023. Its market share hit 32.1%, more than four times that of second-place Cartier. Across the broader luxury sector, virtually no other brand can single-handedly claim such a firm hold on the number-one position in its category the way Rolex does.

Together, Rolex, Patek Philippe, Audemars Piguet, and Richard Mille — four independent titans of watchmaking — accounted for roughly 47% of the market in 2024, up from 36.8% in 2023. Even considering Rolex’s huge contribution, for just four brands to command nearly half the market underscores how concentrated the landscape has become. In other words, the top tier of brands is raking in most of the sales.

The report underscores this shift: high-end watches priced above CHF 50,000 significantly outperformed mid- and entry-level models. Though they make up just 33.5% of Swiss watch exports, they accounted for a massive 84% of total revenue in 2024.

While the “Big Four” strengthened their hold, the major publicly listed groups—Swatch Group, Richemont, and LVMH—saw market share decline.<